Let's Dive Into Saving for Retirement as an Expat

Saving for retirement as an expat generally takes decades. While it might seem far off into the distance, the time it takes for compounding growth to have an outsized effect on your accumulated savings is measured in decades not years.

It’s important to understand that the longer you delay saving for retirement as an expat, the more you’ll need to put aside each month later on. For a healthy savings pot, most of the final value is likely to be interest/capital gain, not the original money contributed. But this is not going to be the case if you only leave yourself a handful of years to save!

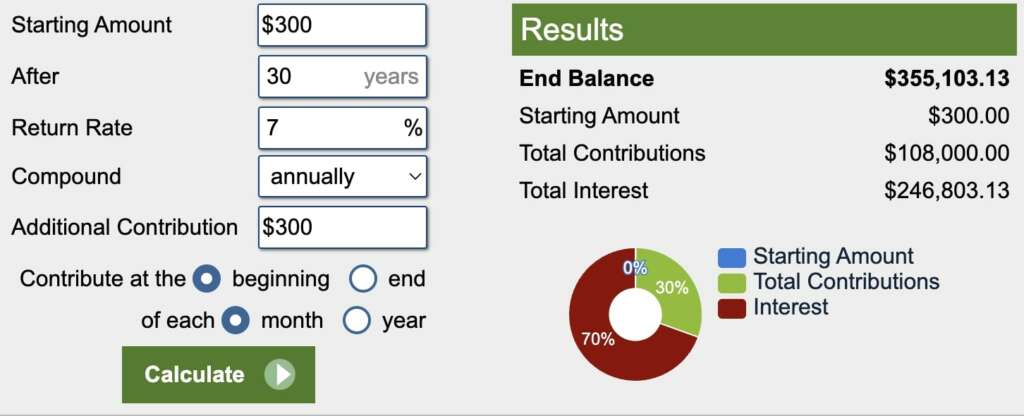

The above illustration shows someone saving $300 per month for 30 years. They are receiving a linear 7% per year return in this example. The total end amount is $355,100. This amount of money often seems out of reach to many, but with compound growth you can see that it can be achieved with a relatively amount saved each month.

Still, is this enough to retire on?

The the answer depends on many factors. Essentially yes, this alone would stop you from starving and you could always opt to live in a low-income country where the penny stretches further. But you would also have to consider the quality of services and medical facilities in such a place.

How much will you need to retire?

Income for retirement is often calculated at around 5% per year of a lump sum. Pension income planning can be complex and the lump sum could still be invested while the retiree is not using it. All of this depends on the person’s unique circumstances and risk profile.

Realistically then $355,000 could be expected to generate an income of around $17,750 per year. In today’s value this is enough to survive on, but not to live comfortably on unless you are in a very cheap country. You do however have to factor in the costs of medical insurance, which are high when someone reaches their 60s and could easily eat away a sizable fraction of this annual income.

More importantly though are the effects of inflation.

Even just 2% per year inflation this annual income would only be worth around $9,800 in today’s value.

Research by the Pensions and Lifetime Savings Association found that the average individual in the UK currently needs £43,000 ($55,400) to retire with a comfortable lifestyle. The number is £59,000 ($76,000) for a couple. American estimations differ, with many hovering around a total $1.5 lump sum needed for a comfortable retirement. The average American has just $88,400 in their retirement account according to CBS News.

Granted, these numbers are for those living in the United Kingdom, and many expats may not desire to return to their home country. But what we tend to see as financial planners is that many people do actually end up returning home as they enter retirement so they can access better medical care and be closer to loved ones in old age.

It would therefore be wise to take those numbers seriously.

As you can see above, while 1.5 million dollars might sound like an unattainable amount, a person would only need to save $1,300 to reach this amount. Now that isn’t a small cost to add to your monthly budget, but it is attainable, especially if someone is focussed on achieving it and is willing to work hard and make occasional lifestyle sacrifices. Bear in mind this is for a comfortable retirement, not a basic or moderate one.

Hopefully you can begin to see that all hope is not lost and that with disciplined savings you can actually secure a dignified later life for yourself.

What about Government pensions?

The State pension in most countries is designed to keep you alive, not to enjoy your life. It is an absolute bare minimum that is often topped up by other benefits in Western countries. These benefits are at risk of being taken away and State pensions are causing significant drag on public finances in many countries.

Overall, it is not wise to rely on State assistance. Many expats don’t even qualify for support back home as they don’t meet the minimum requirements to make voluntary contributions to their social insurance schemes.

Be aware of pension savings you’re missing out on

Most people where I’m from pay National Insurance out of their earned income. They’re also opted in to workplace pensions where part of their salary is put into a pension and their employer tops it up with an additional contribution. These are not things that many expats benefit from and it’s essential to understand that this is something you need to start early with for it to be effective later on.

Pensions and retirement aren’t often thought about by younger people – especially in the West where it’s essentially handled for you in the background via State and workplace pension schemes.

While abroad, it may be wise to consider setting up your own private provision to ensure you’re building wealth over the years and don’t wind up with nothing to fall back on later.

Reach out to discuss your options

If you would like to have a discussion around options for saving, reach out. I am a professional independent financial adviser and would be happy to have a free consultation to assess your situation and provide some initial ideas.

Please see the link below to book in a call via my Calendly.