As a financial adviser in Vietnam, I talk to a lot of people about investing. I talk to clients, friends, strangers… and there’s one common investing mistake that sticks out like a sore thumb.

Everyday investors love to buy and sell their holdings. I’ve always got people asking me when they should buy and when they should sell. Professional investment and pension managers do this as well.

This article is going to show you why frequent buying and selling is the biggest mistake you can make when investing as an expat, and in general.

Frequent Trading Destroys Wealth

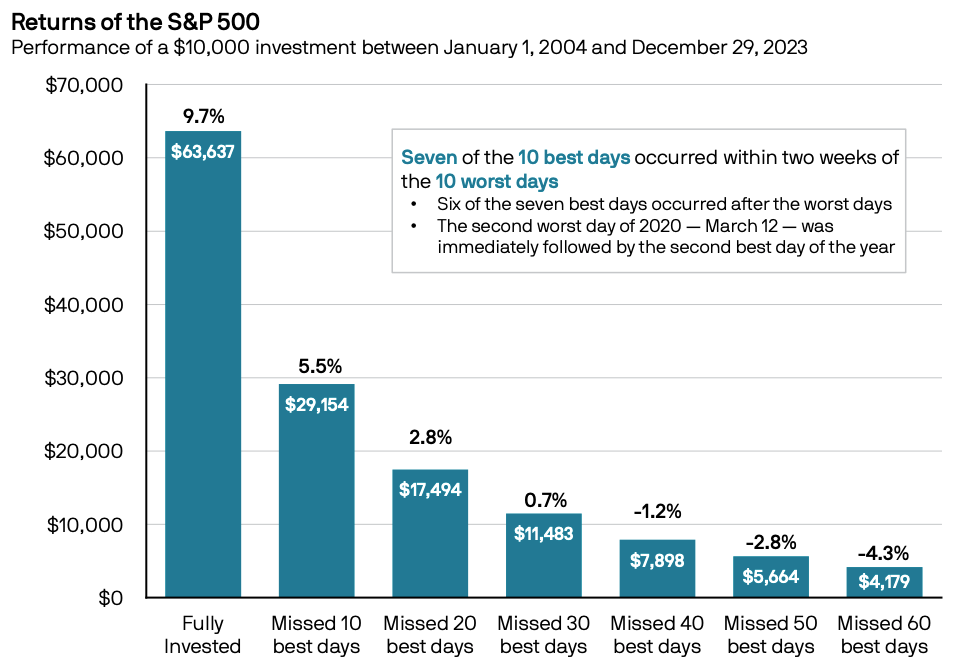

Research from J.P. Morgan Asset Management shows that if you’d invested in the S&P 500 in 2004 and stayed invested the entire time up to 2024, you would have averaged 9.7% per year in returns.

Perhaps that doesn’t sound substantial, so let me put it another way:

That would’ve turned $100,000 into $630,000 during a 20 year period that was marred by the most severe financial crisis in a century, the War on Terrorism, Covid, Russia’s invasion of Ukraine, the first Trump presidency, and much more chaos, war and instability.

All of this was achieved through the simple power of compounding returns.

But to get those returns, you had to be in the market the whole time…

See, if you’d missed just the best 10 performing days over that 20 years, you would’ve made just 5.5% per year and ended up with $290,000.

This is from missing just 10 days out of 7,300! That’s the price of not being in the market. Half those ten days were in bear markets, by the way.

But hang on, the financial self destruction isn’t over yet.

If you’d missed the best 20 days in those 20 years, you’d have made just 2.8% per year! You’d be left with $170,000.

Blimey.

What about the best 30 days?

0.7% per year.

You’d have been better off leaving your money in the bank at this point.

Now let’s really drive the point home…

If you’d missed the best 60 days (two months out of 240)…

You’d have lost 4.3% per year on average and your $100,000 investment would have been worth $41,000. That’s before we even consider inflation.

Can you see my point now?

All investors have to do is stay in the market. They can choose a higher allocation to certain regions or sectors than others; they might prefer different fund management styles; but at the end of the day, it’s about staying invested.

The average person holds a mutual fund for just 3 years.

They talk to their mate in the pub about how her portfolio has performed better than theirs. And they switch. They chase.

Oftentimes, they lose.

Data shows that retail investors on average make significantly lower returns than the market average. It’s not because professionals can read the future. It’s because retail investors are too impatient with their investments.

To quote Warren Buffet: “The stock market is a device to transfer money from the impatient to the patient.”

J.P. Morgan’s Research Visualised:

This illustration shows how $10,000 invested would change after missing the best days in the market. Original image from TKer by Sam Ro.

How Expats in Vietnam Should Invest

It can seem like there aren’t many options for investing as an expat in Vietnam. Many brokerage apps won’t work here, and the local brokers are limited to Vietnamese assets only.

But there is a way you can invest in global markets like the US, the EU, Japan, China, India, and more.

By going through a financial adviser, you can invest via international wealth management platforms. These are designed for expats.

Through an investment platform, expats in Vietnam and elsewhere can gain access to low cost index tracking ETFs for the MSCI World Index, the FTSE All World index, the S&P 500, and much more.

You can also access actively managed mutual funds, which are often preferable when investing in emerging markets, and you can even invest in individual stocks, bonds, commodities like gold and bitcoin, and classic bank deposits.

Time in the Market, Not Timing the Market

The key to successful investing is time in the market. Warren Buffet, while being an incredible investor, is perhaps a little overrated. Buffet has been invested in the markets for some seven decades. This is much longer than most people and allows compounding returns to have an incredible effect on wealth growth.

Most people are timing the market, trying to pick the best times to buy and sell and telling themselves it’s “too unpredictable”. Here’s a news flash: INVESTING IS ALWAYS UNPREDICTABLE.

The cardinal sin of investing is trying to time the market. It doesn’t work. There is 100 years of very reliable data that clearly shows this. Investment professionals aren’t trying to time the market. So why would you?

Oftentimes, it’s a simple misunderstanding from the public about what investing is and how it works.

In short, people confuse investing with trading.

Trading is a short-term exercise that is often employed by investment banks and other institutions to make money out of specific isolated areas. This is treated as a business line and is not the same as investing for the long-term.

The evidence overwhelmingly shows that close to 100% of traders lose money in the long-run.

Global financial institutions employ complex algorithms, quant strategies, and often 100+ years of patterns and data and they still mostly don’t beat “the market”. Oftentimes their goal is not to beat the market, but to use their incredible access to capital to generate multiple diverse business lines.

This is a BAD IDEA for the average investor.

What Should the Average Investor Do?

In short, take a long-term view. Buy diversified indexes and some mutual funds if you like. Hold them for 10+ years. The longer the better. It’s also worth seeking financial advice to ensure you’re not overlooking areas like tax-mitigation, estate planning, risk, retirement income planning, and so on.

Investing is a very small part of a financial plan, and unfortunately most people don’t see it that way. This leads people to miss out on growth, stability, risk mitigation, and peace of mind.

I am biased, of course (because I am a financial adviser!) but I highly recommend that you seek out financial advice when planning investments as an expat in Vietnam. There is a lot more to consider than simply what funds you buy.

That’s all for today. Wish you well.

Until next time…